by RSM US LLP | Feb 15, 2024 | Uncategorized

ARTICLE | February 15, 2024Authored by RSM US LLPExecutive summary: Significant new provisions available to qualified retirement plansQualified retirement plans have seen significant legislative changes over the last few years in the form of both new optional...

by RSM US LLP | Feb 5, 2024 | Uncategorized

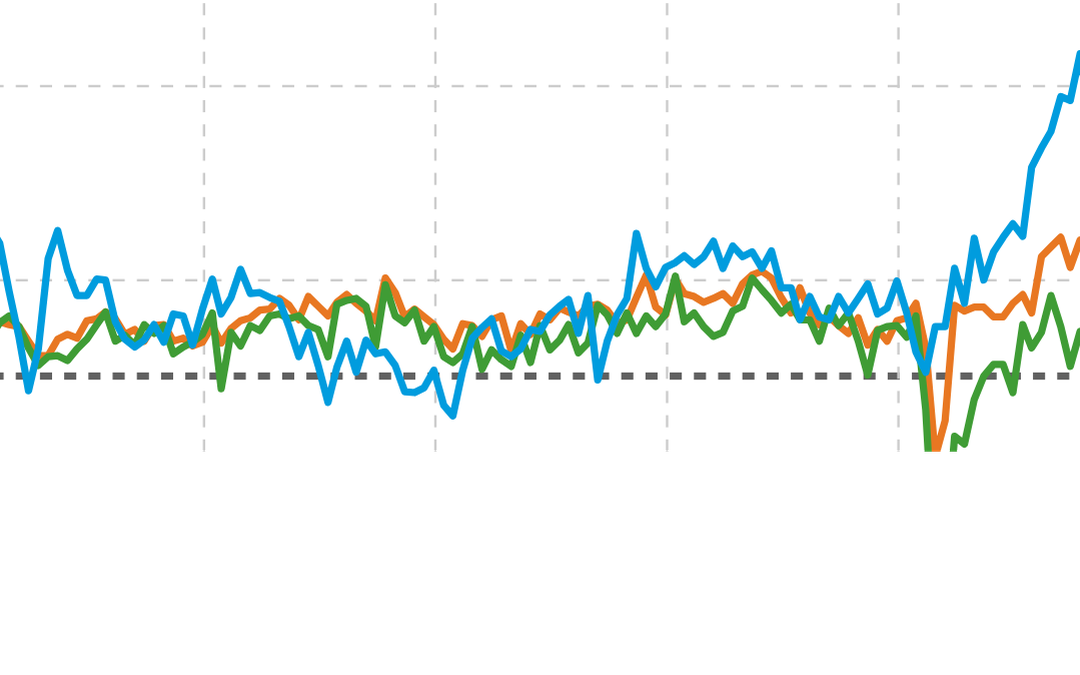

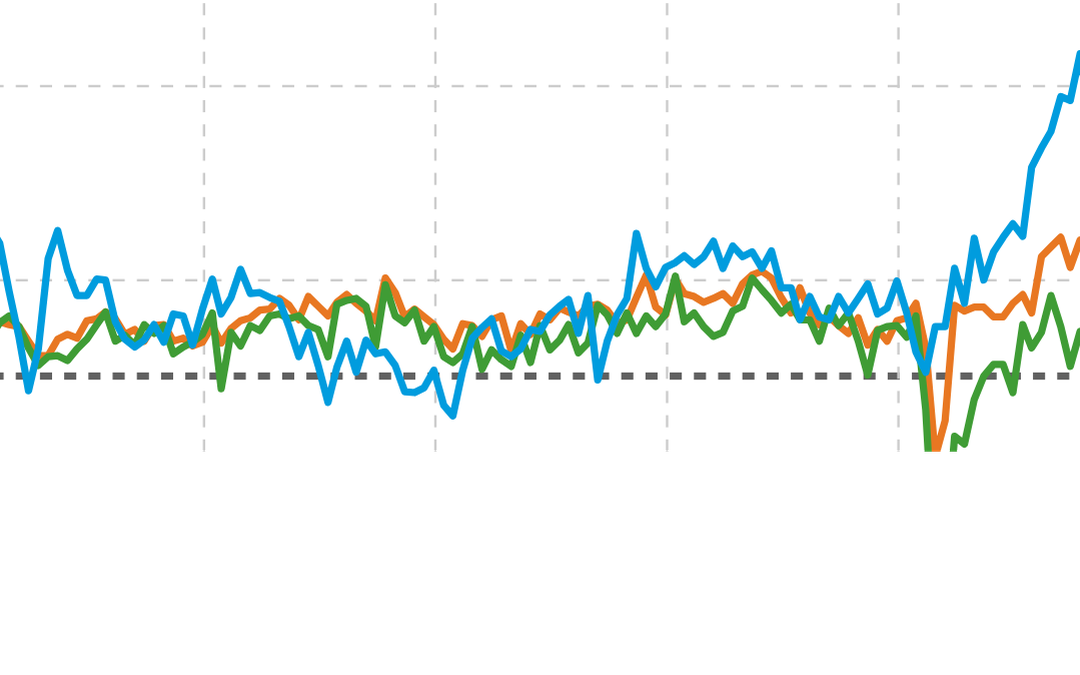

REAL ECONOMY BLOG | February 05, 2024Authored by RSM US LLPThe service sector continued its impressive expansion in January, growing for 43 of the past 44 months, according to the data released by the Institute for Supply Management on Monday.The overall index posted...

by RSM US LLP | Jan 12, 2024 | Uncategorized

ARTICLE | January 12, 2024Authored by RSM US LLPToday’s businesses face an exponentially changing marketplace. Any organization that tries to keep pace using yesterday’s processes will quickly fall behind. Instead, you must change along with it—or even proactively...

by RSM US LLP | Dec 8, 2023 | Uncategorized

ARTICLE | December 08, 2023Authored by RSM US LLPExecutive summary: IRS to target large partnerships and wealthy individualsLarge partnerships and high net worth individuals are the target of a sweeping enforcement effort that artificial intelligence will support, the...

by RSM US LLP | Nov 29, 2023 | Uncategorized

ARTICLE | November 29, 2023Authored by RSM US LLPExecutive SummaryAs 2023 comes to an end and just in time for the holidays, the IRS threw a much needed 'hail Mary’ pass to payment processors and online marketplaces that settle payments for customers by announcing yet...