by RSM US LLP | Feb 20, 2023 | Uncategorized

ARTICLE | February 20, 2023Authored by RSM US LLPThe Internal Revenue Code (the Code) has historically allowed employers to exclude employees who never worked at least 1,000 hours in a 12-month period from an employer sponsored retirement plan. Because of this,...

by RSM US LLP | Oct 7, 2022 | Uncategorized

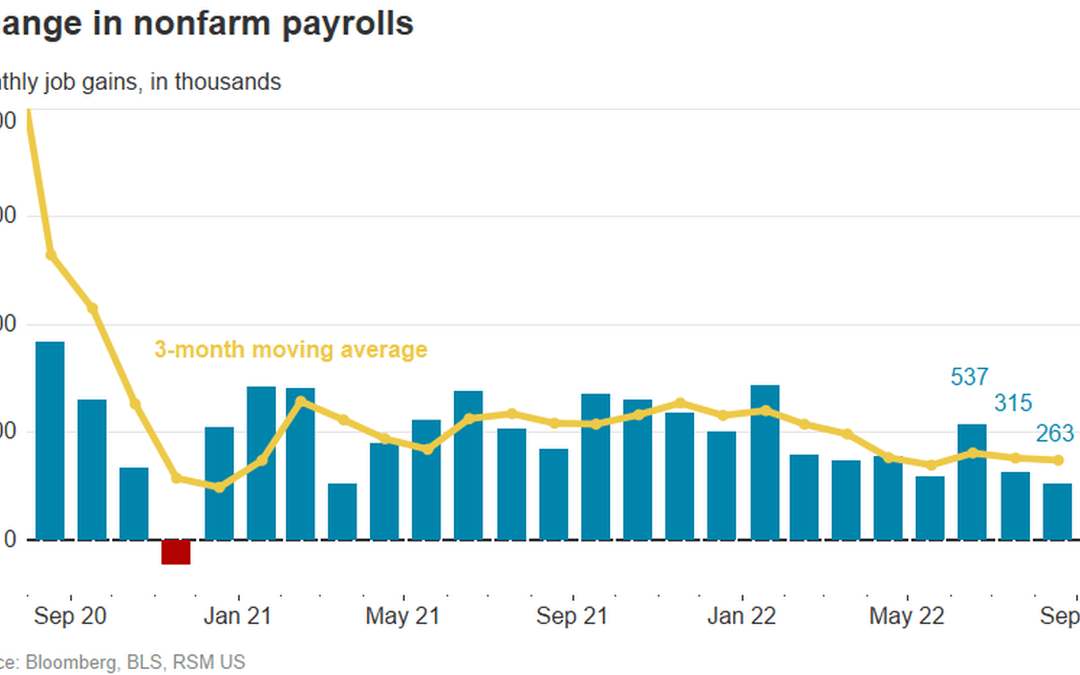

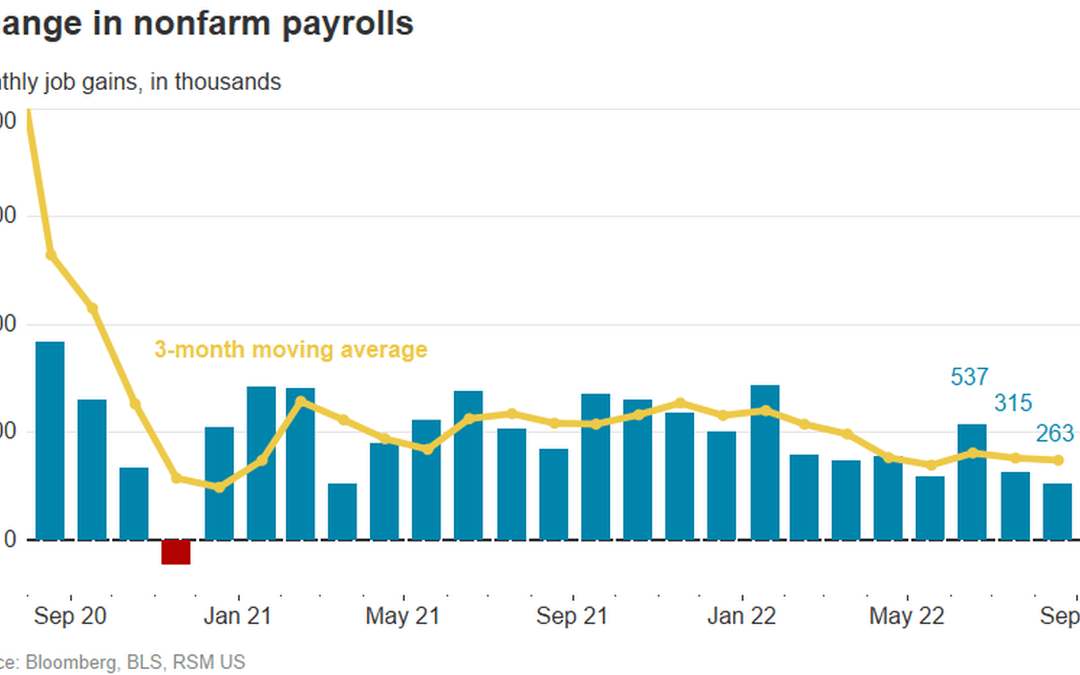

REAL ECONOMY BLOG | October 07, 2022Authored by RSM US LLPThe U.S. economy is proving far more resilient in the face of sustained pricing pressures than otherwise thought a short time ago.The economy added 263,000 jobs in September, slower than the 315,000 jobs in...

by RSM US LLP | Sep 30, 2022 | Uncategorized

TAX ALERT | September 30, 2022Authored by RSM US LLPExecutive summary The IRS issued tax relief for Hurricane Ian victims in Florida. Certain filing and payment deadlines starting on or after Sept. 23, 2022, and before Feb. 15, 2023, will be postponed to Feb. 15,...

by RSM US LLP | Sep 28, 2022 | Uncategorized

TAX ALERT | September 28, 2022Authored by RSM US LLPWhile the most intuitive starting point in establishing a retirement plan is deciding the specific type of plan to adopt, it’s not the only fundamental decision facing employers. Overlooking other factors impacting...

by RSM US LLP | Sep 28, 2022 | Uncategorized

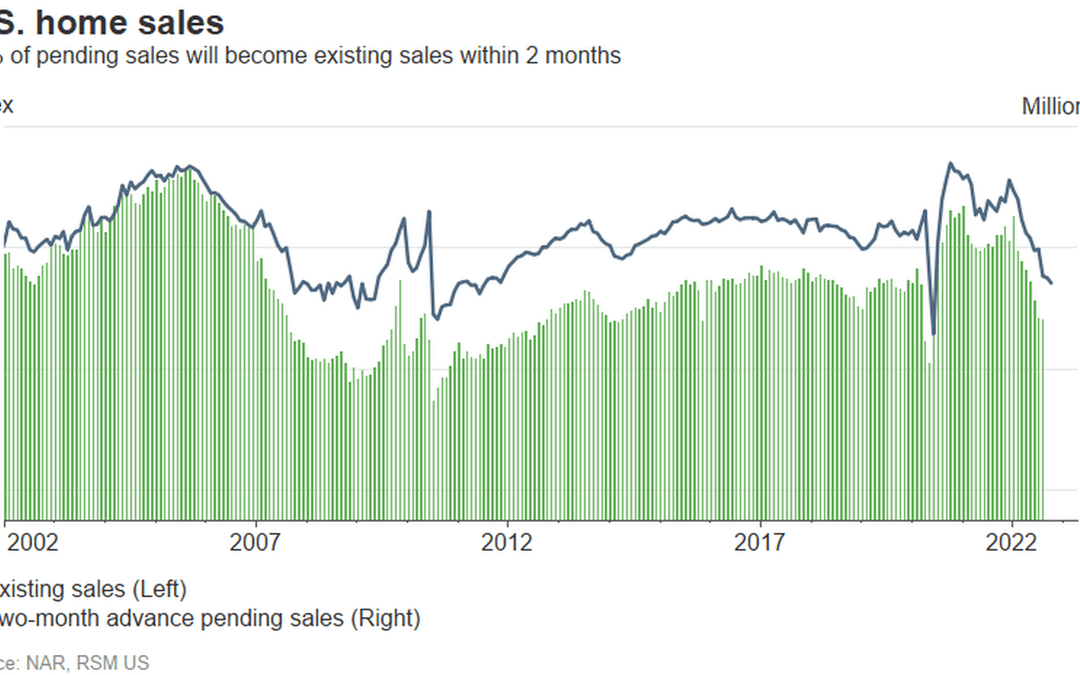

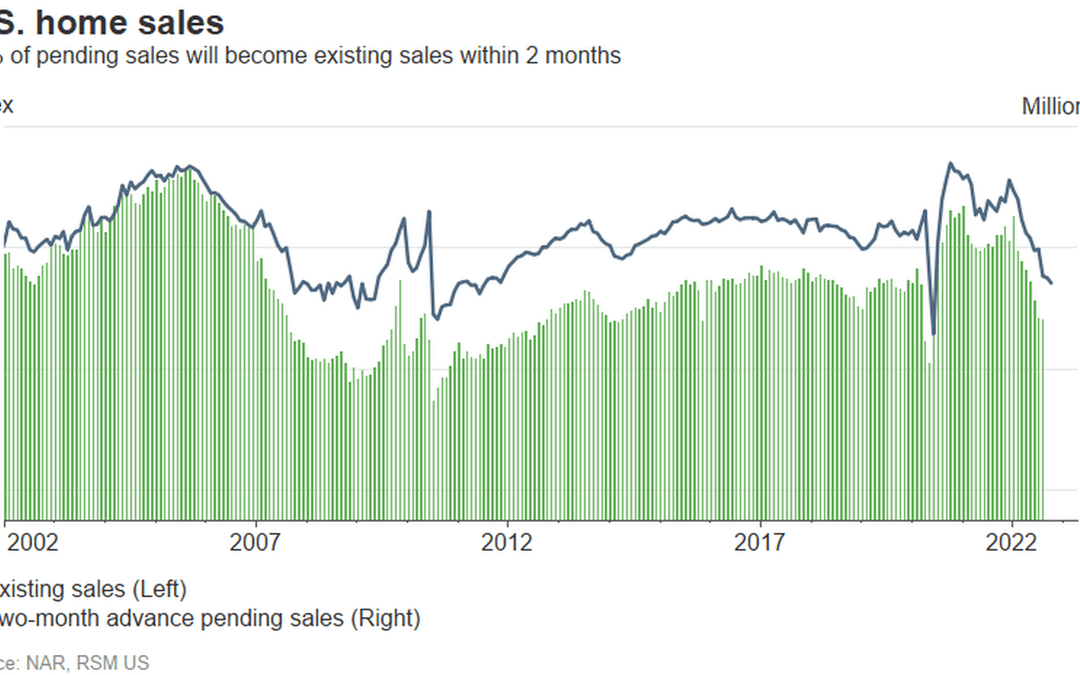

REAL ECONOMY BLOG | September 28, 2022Authored by RSM US LLPPending home sales in the United States fell by 2% in August, the third straight monthly decline amid a steep rise in mortgage rates, according to data released Wednesday by the National Association of...

by RSM US LLP | Sep 12, 2022 | Uncategorized

INFOGRAPHIC | April 27, 2023Authored by RSM US LLPExperts have warned for years that a talent gap crisis was looming, as the steady retirement of Baby Boomers and a younger generations of workers eager to change jobs often chipped away at available resources. Middle...