REAL ECONOMY BLOG | September 28, 2022

Authored by RSM US LLP

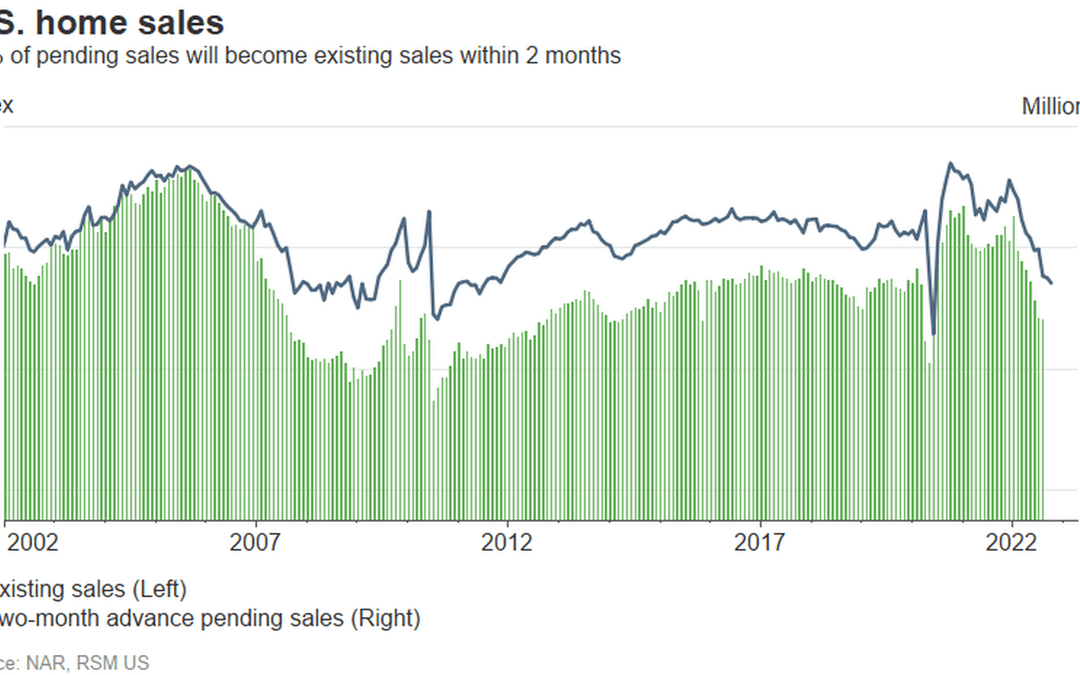

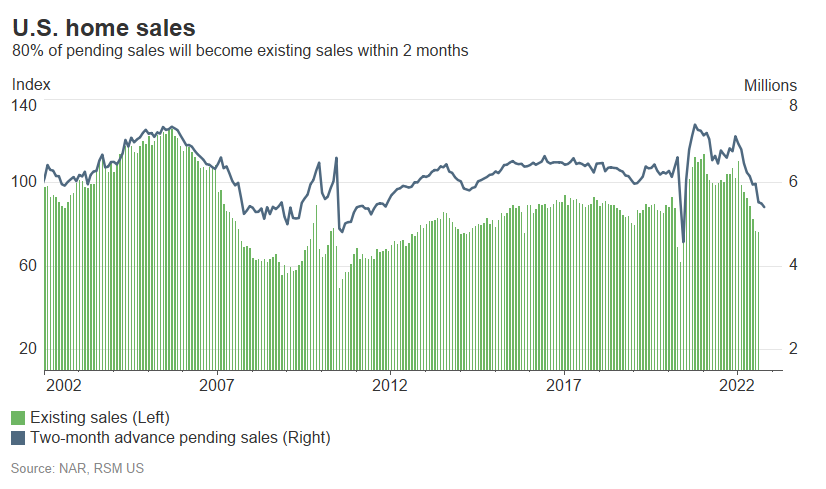

Pending home sales in the United States fell by 2% in August, the third straight monthly decline amid a steep rise in mortgage rates, according to data released Wednesday by the National Association of Realtors.

On a year-ago basis, pending sales fell by a whopping 22.6%, continuing to signal more room for the housing market to fall further.

The Federal Reserve’s price stability campaign is showing its impact not only on overall demand but also on the housing market. That should not come as a surprise because housing accounts for about a third of the average American consumers’ spending basket.

With the Fed remaining hawkish, we expect more rate hikes in the central bank’s last two meetings of the year, pushing the policy rate to the 4.25% to 4.5% range.

Because more than 80% of pending sales become existing sales within two months, sales of existing homes will most likely continue to drop in the coming months.

While the economy has yet to be in a recession, the housing market has been in free-fall in terms of sales since the start of the year. But that does not mean that housing prices will fall as quickly.

The median prices for existing homes remained high, rising by 7.7% on a year-over-year basis, compared to the five-year average before the pandemic of about 5.4%.

We expect housing prices to have a six-to-12-month lag, which means at the current rate, housing price growth should reach negative territory no sooner than next year.

The outlook relies heavily on the Fed’s course of action toward rate hikes. A more aggressive Fed would sink the housing market further, pushing prices down earlier.

Underneath the top-line number, pending sales fell the most in the Midwest, down by 5.2% on the month. Next was the Northeast, down by 3.4%, and the South, down by 0.9%. Sales in the West went the opposite direction, rising by 1.4% in August.

This article was written by Tuan Nguyen and originally appeared on 2022-09-28.

2022 RSM US LLP. All rights reserved.

https://realeconomy.rsmus.com/pending-home-sales-fall-to-their-lowest-level-since-april-2020/

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each are separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/aboutus for more information regarding RSM US LLP and RSM International. The RSM(tm) brandmark is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

Armstrong, Backus & Co, LLP is a proud member of RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise, and technical resources.

For more information on how the Armstrong, Backus & Co, LLP can assist you, please call us at 325.653.6854.